Retirement Taxes: Why People Get Hit With “Underpayment Penalties” (and How to Avoid Them)

If you worked a typical W-2 job most of your career, there’s a good chance you never once thought about “estimated taxes.” And honestly, that makes sense. When you’re working, taxes are handled automatically. Every paycheck has federal and state withholding built in, the IRS gets their cut throughout the year, and you’re free to focus on literally anything else.

But retirement changes the rules.

On our most recent episode of Real Money Pros, we talked about one of the most common surprises retirees run into: even if you pay your taxes in full when you file your return, you can still get hit with an IRS underpayment penalty. That sounds ridiculous at first… until you understand what the IRS is really penalizing.

In most cases, the issue isn’t that someone refused to pay taxes. It’s that they paid them too late.

The IRS isn’t “pay once a year.” It’s pay-as-you-go.

One of the biggest mental shifts retirees need to make is understanding that the tax system isn’t designed for you to pay one big bill each April. The IRS expects taxes to be paid throughout the year, as the income is earned.

When you’re employed, that happens automatically through withholding. Your employer sends money in every pay period without you needing to think about it. That’s one of the reasons estimated taxes feel foreign to so many people—because for most workers, they never had to make those payments themselves.

Once you retire, though, there often isn’t a payroll department doing that work for you anymore. Income might now come from IRA distributions, pension payments, investment interest and dividends, capital gains, rental property, or even a small side business. Some of those income sources can withhold taxes if you ask them to, but many don’t withhold anything by default. If you don’t plan for it, it’s easy to fall behind on paying taxes throughout the year.

The quarterly deadlines you actually need to know.

When people hear “estimated tax payments,” they often assume it’s just an optional thing for business owners. In reality, it can apply to retirees too—especially those with investment or rental income.

The IRS estimated tax system has four payment deadlines. The first three are fairly intuitive: April 15, June 15, and September 15. The last one is the one that gets people: January 15.

That January payment is the estimated tax deadline for income earned from September through December. And yes, it’s due in the next calendar year, which is part of why so many people miss it. It feels like the year is over, but from the IRS perspective, that last payment period still needs to be settled.

If you miss one of these deadlines, it doesn’t mean you’re doomed—but it can result in penalty and interest calculations based on when payments were due versus when they actually came in.

Why retirees get hit with penalties more often than they expect.

Most underpayment penalties happen because retirement income isn’t as “even” as paycheck income.

A retiree might go months taking no distributions, then pull $50,000 or $100,000 from an IRA for a home project, a car purchase, or to build up cash reserves. Or they might sell stock once during the year to diversify out of a concentrated position. Or maybe rental income comes in steadily, but there’s no withholding attached to it.

When income comes in unevenly (or without automatic withholding), taxes don’t get paid evenly either. And that’s the exact situation that triggers the IRS underpayment rules.

This is why so many people get confused. They say, “But I’m not avoiding taxes. I’m going to pay it when I file.”

And the IRS response is essentially: “That’s not how the system works.”

What an underpayment penalty really is (simple explanation).

An underpayment penalty is basically the IRS charging you a “late fee” for not paying your taxes on time throughout the year.

Even if you pay your balance in full by April, the IRS may still assess a penalty if they believe you should have been paying along the way. The system is designed to prevent taxpayers from holding onto money all year and paying later. That’s frustrating, but it’s also the reason estimated payments exist.

The good news is that penalties are often avoidable with a little structure.

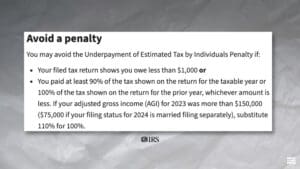

The Safe Harbor Rule: your best defense.

The IRS provides what’s called “safe harbor” rules. These essentially say that if you paid enough during the year, you won’t owe an underpayment penalty—even if you still owe something when you file your tax return.

In most cases, the safe harbor involves paying either at least 90% of the current year’s total tax, or 100% of the prior year’s total tax (and for higher-income taxpayers, sometimes 110%).

This is why tax professionals often start planning based on last year’s tax return. That return gives you a rough target to hit so you don’t stumble into penalties, even if your income changes.

The simplest retiree strategy: use withholding instead of quarterly payments.

Here’s where a lot of retirees can make their life dramatically easier.

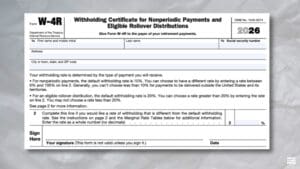

Instead of trying to remember quarterly payment deadlines, many retirees can build a plan around withholding. IRA distributions, pension payments, and in some cases even Social Security benefits can have taxes withheld automatically if you choose to do it.

This is one of the most practical planning points discussed on the show: if you withhold the right amount from your distributions, it often covers the full year and eliminates the need for quarterly payments entirely.

Even better, withholding is typically treated more favorably than estimated payments when it comes to timing. In many situations, withholding is considered “paid throughout the year,” which can protect you from penalties even if the withholding is adjusted later in the year.

That makes withholding one of the cleanest tools retirees have.

Two good approaches (pick the one that fits your situation).

If you’re trying to build a simple system, you really have two workable paths.

The first is a withholding-based retirement plan. This is great for retirees living on pensions, IRA withdrawals, and Social Security. You calculate your approximate annual tax burden, then spread that out through withholding on monthly distributions. It’s simple, predictable, and it removes the pressure of quarterly deadlines.

The second is a true estimated payment plan. This is more common for retirees who have rental income, significant investment income, or irregular taxable events. In this case, you accept the quarterly deadlines as part of the system and treat estimated payments like your payroll-withholding substitute.

Neither is wrong—the key is consistency. The worst thing you can do is drift through the year without a plan and hope April works itself out.

What if you already missed a deadline?

This happens more often than people want to admit.

If you’ve already missed a quarterly payment (or more), the best move is usually to pay as soon as possible. Late is still better than never, and the longer the gap, the more interest and penalties can build.

This may also be the moment to switch to a withholding-based plan going forward. In many cases, using withholding helps people get back on track without having to chase quarterly deadlines the rest of the year.

A simple action plan you can actually follow.

If you want a clean way to handle this without turning your retirement into a tax project, here’s the practical approach:

Start by pulling out last year’s tax return and look at the total tax you paid. That’s your starting reference point. Next, decide whether your situation is better suited for withholding or quarterly estimated payments. Then take the next simple step: adjust withholding on your distributions (or set quarterly payments) so taxes are being paid steadily throughout the year.

And here’s the part most people skip: check it mid-year. Just one mid-year review in June or July can prevent a big surprise.

Final takeaway.

Most retirees don’t get hit with underpayment penalties because they’re trying to do something wrong. They get hit because the system quietly changes when paychecks stop. Payroll withholding disappears, income becomes irregular, and taxes don’t get paid consistently throughout the year.

But the solution doesn’t have to be complicated.

If you set up a simple withholding strategy or stay consistent with quarterly payments, you can eliminate tax surprises, avoid penalties, and keep retirement planning focused on what it should be: enjoying your life—not guessing what the IRS expects.

Disclosure

Apollon Wealth Management, LLC dba Tree City of Apollon (Apollon) is an investment advisor registered with the SEC. This document is intended for the exclusive use of clients or prospective clients of Apollon. Any dissemination or distribution is strictly prohibited. Information provided in this document is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product or service. Advice may only be provided after entering into an engagement agreement and providing Apollon with all requested background and account information. When making any tax or legal decisions clients should always seek out specific professionals such as legal counsel or a CPA. This piece is provided for information only and is in no way tax advice. While every effort has been made to ensure accuracy, only the IRS tax code itself should be considered official. Apollon does not file taxes for any clients. Please visit our website https://apollonwealthmanagement.com for other important disclosures.

Resources

Internal Revenue Service. “Estimated Tax.” Internal Revenue Service, https://www.irs.gov/faqs/estimated-tax. Accessed 13 Jan. 2026.

Internal Revenue Service. “Individuals — When to Pay Estimated Tax.” Internal Revenue Service, https://www.irs.gov/faqs/estimated-tax/individuals/individuals-2. Accessed 13 Jan. 2026.

Internal Revenue Service. “Pay as You Go, So You Won’t Owe: A Guide to Withholding, Estimated Taxes, and Ways to Avoid the Estimated Tax Penalty.” Internal Revenue Service, https://www.irs.gov/payments/pay-as-you-go-so-you-wont-owe-a-guide-to-withholding-estimated-taxes-and-ways-to-avoid-the-estimated-tax-penalty. Accessed 13 Jan. 2026.

Internal Revenue Service. “Topic No. 306, Penalty for Underpayment of Estimated Tax.” Internal Revenue Service, 4 Dec. 2025, https://www.irs.gov/taxtopics/tc306. Accessed 13 Jan. 2026.

Internal Revenue Service. “Underpayment of Estimated Tax by Individuals Penalty.” Internal Revenue Service, https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty. Accessed 13 Jan. 2026.

Internal Revenue Service. “About Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments.” Internal Revenue Service, 2 Aug. 2025, https://www.irs.gov/forms-pubs/about-form-w-4-p. Accessed 13 Jan. 2026.

Internal Revenue Service. “About Form W-4V, Voluntary Withholding Request.” Internal Revenue Service, 19 Feb. 2025, https://www.irs.gov/forms-pubs/about-form-w-4-v. Accessed 13 Jan. 2026.

Social Security Administration. “Request to Withhold Taxes.” Social Security Administration, https://www.ssa.gov/manage-benefits/request-withhold-taxes. Accessed 13 Jan. 2026.

Kiplinger. “When Are Estimated Tax Payments Due for 2025?” Kiplinger, 2025, https://www.kiplinger.com/taxes/tax-deadline/602538/when-estimated-tax-payments-due. Accessed 13 Jan. 2026.

Real Money Pros. “How to Profit From the Headlines: Venezuela, Oil Opportunities, and Critical Tax Moves for 2026 (1/10/2026).” Real Money Pros, aired 10 Jan. 2026.