Free Social Security Advice Can Be the Most Expensive Kind

Most people treat Social Security like routine paperwork. They assume it’s automatic, straightforward, and that the Social Security office will help them make the right choice. A friend files at 62 or 67, so they plan to do the same. An online calculator gives a number, and that feels good enough.

But Social Security isn’t just a form to fill out. It’s one of the biggest lifetime income decisions retirees will ever make! And once the choice is made, it’s largely permanent.

Imagine two neighbors. Both worked similar careers and earned similar benefits. One files at 62 because “that’s what everyone does.” The other waits until 70. Twenty years later, one has collected less total income and their surviving spouse receives a smaller benefit for life.

Small timing decisions can create very different lifetime outcomes.

What People Think Social Security Is.

Many retirees believe Social Security is:

- A simple age decision

- The same for everyone

- Just another benefit to “turn on”

In reality, it’s a strategy decision that affects:

- Lifetime income

- A spouse’s benefits

- Survivor income

- Taxes

- Retirement withdrawal plans

It’s not just about when you file. It’s about how that decision fits into your entire retirement picture.

What the Social Security Office Actually Does.

The Social Security Administration (SSA) has an important role, but it’s not a planning role.

They help with:

- Verifying eligibility

- Explaining rules

- Processing applications

They do not:

- Run lifetime income comparisons

- Optimize filing strategies for married couples

- Model survivor benefit outcomes

- Coordinate your decision with taxes or investments

The Social Security office explains rules. It does not design retirement strategies. This is a very common misconception and just leads to tons of frustration after waiting on hold for five hours. Knowing what they can and cannot do ahead of time is invaluable!

Why This Decision Is High Stakes.

A difference of a few hundred dollars per month might not sound life-changing. But stretch that over 20–30 years of retirement, and it becomes a six-figure decision.

And for married couples, the stakes are even higher because one person’s decision affects the other — especially the surviving spouse.

Social Security Is Longevity Insurance.

One of the biggest misunderstandings is thinking Social Security is just about getting “your money back.” Social Security is actually insurance against living a long time.

From full retirement age to age 70, benefits increase by roughly 8% per year. That higher amount doesn’t just last for a year — it lasts for life. If someone lives into their 80s or 90s, that larger monthly benefit can provide a powerful financial cushion when other assets may be under pressure.

Delaying benefits isn’t just about bigger checks. It’s about protecting income later in life, when flexibility is often lower.

Why “Break-Even Age” Thinking Misses the Point.

A common question is, “What’s the break-even age?”

This compares how long it takes for delayed benefits to “catch up” to taking benefits earlier.

But that math leaves out major factors:

- Survivor benefits

- Taxes

- Portfolio withdrawals

- Uncertainty about lifespan

It’s not just about breaking even. It’s about managing risk, especially the risk of outliving your money.

The Spousal and Survivor Piece Most People Miss.

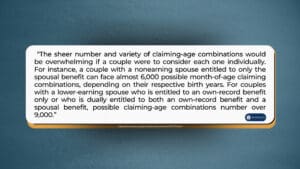

For married couples, this decision is even more complex.

If one spouse delays, the surviving spouse may receive that higher benefit for the rest of their life. Filing early can permanently reduce what a widow or widower receives.

This is where copying a friend’s strategy can go wrong. Their health, income, work history, and age differences may be completely different.

The Ripple Effect Into Taxes and Retirement Income.

Social Security decisions don’t happen in isolation.

When you file can affect:

- How much of your benefits are taxable

- How much you need to withdraw from retirement accounts

- How long your investments need to last

- Medicare-related income considerations

One decision can influence multiple parts of your retirement plan!

Why “Free” Advice Can Cost People.

Free advice usually means:

- No personalized analysis

- No scenario comparisons

- No coordination with your other financial decisions

The cost isn’t a bill. The cost is missed income, permanent reductions, and a strategy that doesn’t match your situation. Please work with an expert!

What Good Social Security Planning Actually Looks Like.

A thoughtful approach includes:

- Comparing multiple filing ages

- Evaluating spousal and survivor outcomes

- Considering health and longevity expectations

- Coordinating with tax planning

- Aligning with retirement withdrawals

It’s not about finding one “right age.” It’s about choosing the right strategy for your life.

Don’t Hesitate to Pay for Advice!

Social Security is one of the few retirement decisions that can’t easily be undone. Taking time to understand the long-term impact can make a meaningful difference in income, taxes, and security later in life.