Trump Accounts: A New Way to Save for Kids — Or Just Political Hype?

Headlines about “Trump Accounts” and a multi-billion-dollar cash infusion have a lot of parents asking the same thing: “Is this actually a good way to save for my kids, or just political noise?”

Short answer: Trump Accounts are real, they offer some legitimate advantages, and they also come with quirks and limitations that make them very different from tools like 529 plans or custodial Roth IRAs.

This breaks down exactly how they work, what benefits they offer, what drawbacks you need to know, and — most importantly — how they stack up against other options parents already use.

What Exactly Is a Trump Account?

A Trump Account is a new tax-advantaged account for children under age 18. It’s set up and managed by a parent or guardian until the child becomes an adult. Think of it as a retirement-style account for kids, with federal seed money, employer contribution options, and strict rules about how the money is invested.

Here’s how it works:

1. Federal “Seed Money” for Certain Birth Years

Children born between 2025–2028 may be eligible for a $1,000 federal contribution once the account is opened and a parental election is filed. This is the part that gets the most attention — “free $1,000 for every new baby.” And yes, it’s real. But it applies only to those specific birth years and requires a formal election.

2. Additional Funding Sources

A Trump Account can receive:

- Parent contributions

- Employer contributions (up to $2,500 per year per child)

- Private donor funding (such as the recent $6.25 billion pledge by the Dell family)

- Rollover contributions from other Trump Accounts

3. Contribution Limits

During the childhood “growth period,” you can contribute:

- Up to $5,000 per child per year (2026–2027), indexed for inflation in later years

- Employer contributions do NOT count against this limit

- There’s no earned income requirement

This is a big differentiator from Roth IRAs — your kid does not need a job to save into a Trump Account.

4. Investment Restrictions

During childhood, the account can only hold:

- Ultra-low-fee index funds

- The fund must track a broad U.S. equity index

- Total fund expenses must be 0.10% or lower

- No ESG funds, no sector funds, no bonds, no individual stocks

- Cash can only be held for settlement, not long-term

In other words… 100% broad U.S. stock market exposure. Nothing else.

5. What Happens at Age 18?

When the child reaches the age of majority:

- The Trump Account converts into an IRA-type account for the child

- IRA-style distribution rules apply

- Withdrawals of earnings are taxable; early withdrawals face the traditional 10% penalty unless they qualify for an exception

Trump Accounts are not education accounts. They are retirement-style accounts. That means there are tax consequences for dipping into them early.

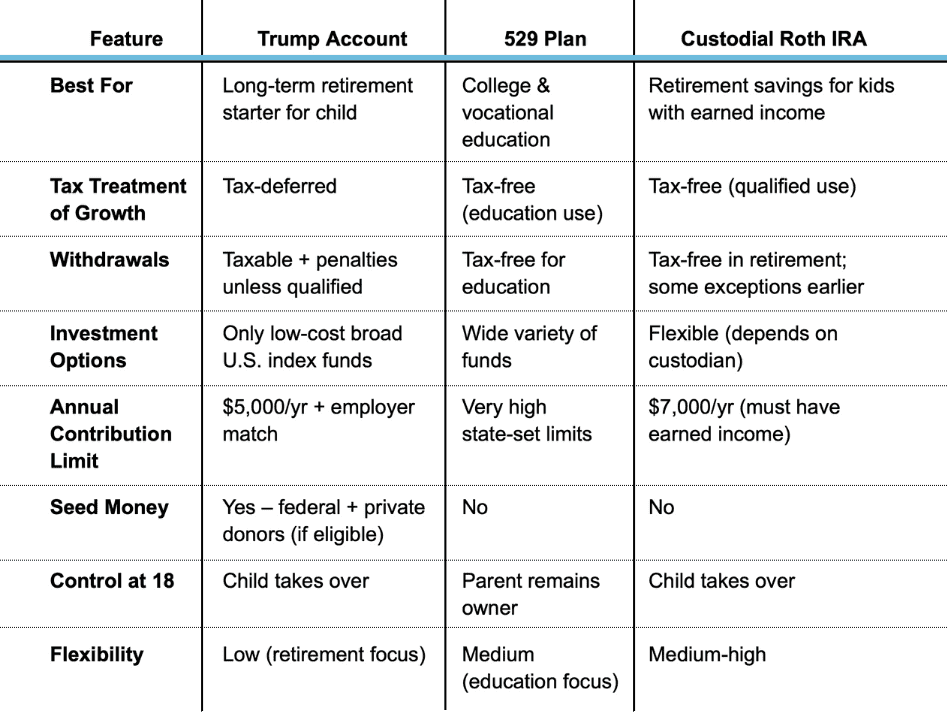

How Do Trump Accounts Compare to 529s and Custodial Roth IRAs?

Here’s where the rubber meets the road. Each account type is built for a completely different purpose.

529 Plans

Best for: Education, vocational training, and K–12 tuition (in some states) 529s remain the best education savings tool in America.

Why parents use them:

- Tax-free growth

- Tax-free withdrawals for qualified education expenses

- Some states offer tax deductions or credits for contributions

- Extremely flexible investment menus (index funds, target-date funds, etc.)

Drawbacks:

- Non-qualified withdrawals trigger taxes + 10% penalty

- Funds are intended for education; not ideal for retirement or general purpose savings

Custodial Roth IRA (for kids with earned income)

Best for: Teenagers who earn money and have time on their side

A custodial Roth IRA can be one of the most powerful tools for a child — but it requires earned income (W-2 or documented self-employment).

Why they’re powerful:

- Tax-free growth

- Tax-free withdrawals in retirement

- Early withdrawal exceptions for:

- First-time home purchase

- Education

- Certain emergencies

- Investment flexibility (stocks, bonds, ETFs, etc.)

Drawbacks:

- Requires earned income

- Low annual contribution limits compared to Trump/529

- Child takes full control at age of majority

Trump Accounts

Best for: Long-term, retirement-style investing for young kids — especially if you qualify for free seed money

Strengths:

- $1,000 federal seed for 2025–2028 births

- Additional private donor contributions

- Employer contributions (not taxable to the parent)

- No earned income needed

- Tax-deferred growth

- Separate from IRA contribution limits (you can do both)

Drawbacks:

- Strict investment menu: only ultra-low-fee U.S. broad index funds

- No bond funds, no TDFs, no customization

- No education-specific tax break (unlike 529s)

- Early withdrawals behave like IRA withdrawals (taxed + penalty)

- Parents lose control at age 18

Which One Should Parents Choose?

✔ Want to save for college?

529 wins, hands down.

✔ Want to help your child build long-term wealth?

Trump Account (if eligible for the seed money) or Custodial Roth IRA (if your child has earned income)

✔ Want full flexibility and full parental control?

Neither of those — instead use a:

- Parent-owned brokerage account,

- Earmarked for the child,

- With the child listed as beneficiary.

That keeps control with you, avoids penalties, and allows the investments to match your actual plan.

✔ Want to combine multiple advantages?

A strong “stacked strategy” for many families may look like:

- 529 Plan for education

- Trump Account for retirement-style growth

- Brokerage account for opportunities (first car, wedding, first home, etc.)

- Custodial Roth IRA once the child earns income

This gives tax benefits, flexibility, and multiple paths for the child’s future.

Final Thoughts: Trump Accounts Are a Tool — Not a Magic Solution

Trump Accounts introduce a new, highly restrictive but potentially powerful way to plant long-term seeds for your children’s financial lives. The $1,000 federal starter and employer-match possibilities are real benefits. But the account is not a substitute for:

- A 529 plan,

- A Roth IRA,

- A well-designed education or opportunity fund,

- Or a broader financial plan.

They are one tool — not the tool.

If your child qualifies for the free money, it’s worth adding to the mix. But like anything in personal finance, the right account comes down to intent, timeline, and control.

Have questions on how to add these tools to your financial arsenal? Reach out to us today!

Disclosure

Apollon Wealth Management, LLC dba Tree City of Apollon (Apollon) is an investment advisor registered with the SEC. This document is intended for the exclusive use of clients or prospective clients of Apollon. Any dissemination or distribution is strictly prohibited. Information provided in this document is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product or service. Advice may only be provided after entering into an engagement agreement and providing Apollon with all requested background and account information. When making any tax or legal decisions clients should always seek out specific professionals such as legal counsel or a CPA. This piece is provided for information only and is in no way tax advice. While every effort has been made to ensure accuracy, only the IRS tax code itself should be considered official. Apollon does not file taxes for any clients. Please visit our website https://apollonwealthmanagement.com for other important disclosures.