Why a Smart Tax Move Can Increase Your Medicare Bill

We talk about it all the time… Roth conversions are one of the most powerful tax-planning tools available in retirement. They can reduce future Required Minimum Distributions (RMDs), create tax-free income later, and give retirees more control over their long-term tax picture.

But there’s a planning detail many people overlook — one that can lead to higher Medicare premiums down the road. A Roth conversion can raise what you pay for Medicare. And the increase often shows up two years later. Let’s talk about it.

WHAT IRMAA IS.

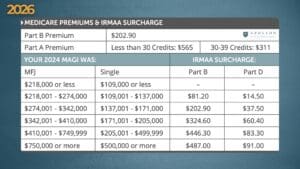

Medicare Part B (doctor and outpatient coverage) and Part D (prescription drug coverage) premiums aren’t the same for everyone. Higher-income retirees pay more.

The extra charge is called IRMAA — Income-Related Monthly Adjustment Amount.

If income exceeds certain thresholds, Medicare adds a surcharge on top of standard premiums. It applies to Part B and Part D.

WHAT CATCHES PEOPLE OFF GUARD: THE 2-YEAR LOOKBACK.

Medicare doesn’t use your current income to calculate IRMAA. It uses your tax return from two years prior.

That means financial decisions today can affect Medicare premiums later.

Example:

- A retiree does a large Roth conversion in 2024.

- Medicare premiums in 2026 are based on 2024 income.

- Result: higher premiums — even though the conversion happened two years earlier.

WHY A ROTH CONVERSION TRIGGERS THIS.

Money moved from a pre-tax retirement account (like a Traditional IRA) into a Roth IRA is treated as taxable income in the year of the conversion.

That additional income increases Modified Adjusted Gross Income (MAGI), the figure Medicare uses for IRMAA calculations.

Even a conversion meant to reduce future taxes can create a short-term income spike that pushes someone into a higher IRMAA bracket.

THE “IRMAA CLIFF” PROBLEM.

IRMAA is structured in tiers.

Crossing a threshold — even by a small amount — can mean paying the full higher premium for that bracket.

This is often called the IRMAA cliff. Income doesn’t just rise gradually with premiums. A small change can lead to a noticeable jump in monthly Medicare costs.

A SIMPLE EXAMPLE.

A married couple typically has an income of $210,000.

They convert $60,000 from an IRA to a Roth.

Their income becomes $270,000 for that year.

That increase could move them into a higher IRMAA bracket, leading to larger Medicare premiums two years later.

They didn’t do anything wrong — they just didn’t realize how Medicare uses income.

DOES THIS MEAN ROTH CONVERSIONS ARE A BAD IDEA?

Not at all.

Roth conversions can still be extremely valuable. They can:

- Reduce future RMDs

- Lower lifetime taxes

- Provide tax-free income later

- Help manage estate planning

The key is understanding that every strategy involves trade-offs. Paying higher Medicare premiums for a year or two might be worth it if it prevents much larger tax bills later.

The problem isn’t Roth conversions. The problem is doing them without considering Medicare rules.

HOW TO PLAN AROUND IRMAA.

Here are practical ways retirees can manage the impact:

Convert in stages

Instead of one large conversion, spreading conversions across several years may help keep income within more favorable brackets.

Know the income thresholds

Before converting, estimate where your income will land and how close it is to IRMAA tiers.

Watch the timing

Conversions in your early 60s can affect Medicare premiums when you first enroll at 65.

Look at the whole tax picture

A Roth conversion may also affect taxation of Social Security, credits, or other income-based calculations.

Know when appeals apply

If income drops due to retirement, loss of pension, divorce, or other qualifying events, IRMAA adjustments can sometimes be appealed.

THE BOTTOM LINE.

Roth conversions are a smart planning tool — but they increase taxable income in the year they’re done. Because Medicare premiums are tied to income from two years earlier, that spike can lead to higher Part B and Part D costs later.

This doesn’t make Roth conversions a mistake. It simply means they should be coordinated with Medicare rules, tax brackets, and long-term income planning.

Understanding the ripple effects helps retirees make informed decisions, not just reactive ones.

Disclosure:

Apollon Wealth Management, LLC dba Tree City of Apollon (Apollon) is an investment advisor registered with the SEC. This document is intended for the exclusive use of clients or prospective clients of Apollon. Any dissemination or distribution is strictly prohibited. Information provided in this document is for informational and/or educational purposes only and is not, in any way, to be considered investment advice nor a recommendation of any investment product or service. Advice may only be provided after entering into an engagement agreement and providing Apollon with all requested background and account information. When making any tax or legal decisions clients should always seek out specific professionals such as legal counsel or a CPA. This piece is provided for information only and is in no way tax advice. While every effort has been made to ensure accuracy, only the IRS tax code itself should be considered official. Apollon does not file taxes for any clients. Please visit our website https://apollonwealthmanagement.com for other important disclosures.